The Art of Flipping Houses: A Comprehensive Guide for Beginners

Are you seeking other ways of earning money through flipping homes with big ROI this year? Well, you’ve just stumbled upon the right page!

Let’s face it; many jobs have sprouted from here and there, mainly with the use of the internet, and applying for one has never been more convenient nowadays.

In fact, there are about seven million employments produced by the commercial internet directly, while another 10.65 million jobs were created indirectly by individuals working for internet-based businesses to supply service demands.

So, with many options online for earning money, would flipping houses still be worth it?

Of course, it is!

See, about 92% of any real estate investment makes good ROI on house flips in the real estate market.

In fact, about 60% of the investment property in house-flipping business made £10k-£75k profit in the UK alone.

Now, that shows a promising future for house flippers!

That’s why if you’re looking to flip a house, I prepared a guide that you can always read whenever and wherever you are.

I’ll try to make this blog as comprehensive as possible while making it an easy-to-digest read, especially for beginners like you.

Understanding What House Flipping Is

You need to understand first that flipping houses isn’t for everyone.

Why? Let’s know what house flipping is in the first place so that it’ll be easier for you to navigate the house flipping market.

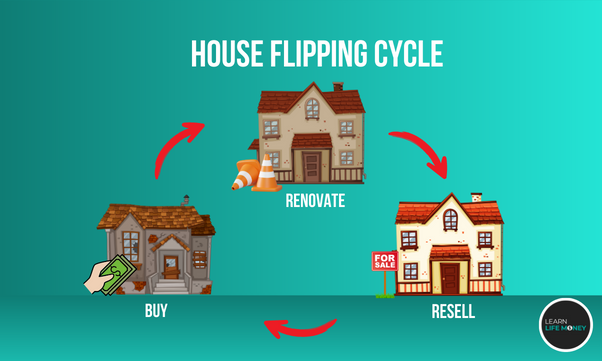

In its simplest definition, house flipping, or flipping houses, whatever you call it, is about buying a house, upgrading it through remodelling or renovation, and then selling it for a higher valuation.

Take note! You must first understand the real estate industry to house flip, fund possibilities, and build procedures effectively.

You may also try seeking online resources, webinars, or professional advice from experts with a great deal of house-flipping experience.

So, why it isn’t for everyone?

Well, you need a lot of business and research skills to get a big ROI in house flipping since the entire house-flipping process takes a lot of time, money, and effort.

If you’re not good enough for this, you might fail flipping houses, and you’ll end up wasting your investment property.

How to Do House Flipping

The first step to house flip, of course, is to do your research.

Ensure you have all the best possible options in hand before you zero into a particular house you’d like to flip.

Here’s a simple step-by-step guide:

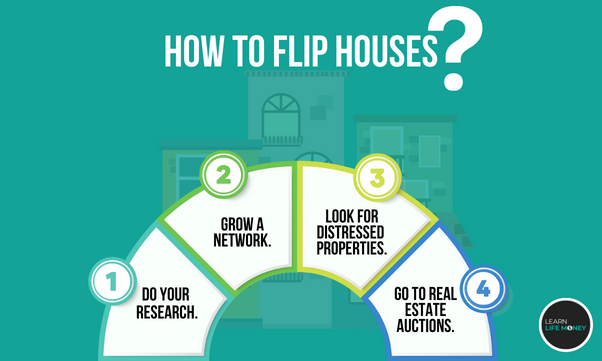

- Do your research. Seek places where there’s a high demand for homes, a shortage of available housing, and growing property values. With this, your chances of your house flipping being successful is high.

- Grow a network. When looking for properties to flip, networking with a real estate agent, broker, and contractor can be a huge asset. They provide leads on possible deals.

- Look for distressed properties. Short sales and foreclosures are two examples of distressed real estate that you can buy for less money than they’re worth. They’re good for house flippers such as you.

- Go to real estate auctions. The gold mine of house flippers is real estate auctions. If you’re prepared to put in the effort, you might be able to uncover some fantastic offers because properties sold at auctions are often priced below market value.

Tips When Searching for a House to Flip

Now that you know the basics of doing house flipping, let’s try to zoom in a little bit on some important factors when searching for a house to flip:

Research for Your Ideal Real Estate Market

Before you start to flip a house, study the local real estate market trends in house flipping and keep updated on any variables, such as interest rates, employment growth, and new projects that can have an influence on your business.

It’s also crucial to look for homes in flourishing communities or high-demand regions. The value of your investment here is higher, and it’s easier to attract buyers.

A flipped house in a marketable place can sell high and easily.

Evaluate the Properties Condition

Before flipping a house, you must carefully assess the condition of it.

Try to optimize your return on investment by searching for homes that require cosmetic rather than structural upgrades.

To flip a house without spending a fortune, cosmetic improvements like painting, landscaping, and new fixtures may significantly enhance the appeal of a house.

On the other hand, structural fixes, such as faulty foundations or outdated roofs, can be expensive and time-consuming.

Set a Budget and House Flipping Business Plan

It’s highly advisable to work with real estate agents or look for houses that need little work if you’re short on time or don’t have the expertise to finish repairs.

Remember, finding a house in need of TLC is important, but try to stay away from properties that need expensive or significant structural work. As mentioned above, look for ones that only need fresh paint, flooring, or fixtures as much as possible.

But why, though? Why not just do a major renovation project when flipping a house to skyrocket its overall real estate pricing?

Because as a house flipper, it’s important that you aim for at least 20-30% profit while working on a budget.

That’s why determining your budget before beginning your search is important, including the repair costs and miscellaneous; otherwise, there’s not much of an ROI.

Confirm Your House Flipping Financing

For your house flipping loans, consider any hard money loan, private money loan, or even teaming up with other real estate investors if you think traditional mortgage loans aren’t ideal for you when you start flipping houses.

Of course, always compare their interest rates to know which one is the best loan you can get that can leverage your business in flipping a house.

Building Your House Flipping Team

Building a solid team of experts is crucial to the success of house flipping.

Here are some factors you must consider when building your own team:

Real Estate Agent

A knowledgeable and experienced real estate agent, broker, or realtor, in general, is a must-have for any house-flipping team.

They’ll help you find properties with potential, negotiate the best purchase price, and ultimately sell the finished product for a profit.

When looking for a real estate agent, follow these:

- Look for real estate agents that have a history of profitable flips and market expertise in your area.

- Request recommendations from other investors or business experts.

- Interview various agents to choose the one that mostly suits your requirements and objectives.

Contractor

Your contractor is in charge of managing the remodeling process of flip houses and making sure that all work is finished on schedule and within your specified budget.

They’ll aid you in making crucial choices about the project’s scope and what upgrades will provide the highest return on investment.

When looking for a contractor, follow these:

- Ask for recommendations from other investors, realtors, or close friends and family.

- Check out the reviews and rankings on websites like HomeAdvisor and Angi.

- Request quotes for the work you need to be done and conduct interviews with several contractors as needed.

Financial Partners

If you don’t have a lot of money on hand, you’ll probably need financing for your house-flipping journey.

Try looking for a private lender, hard money lender of hard money loans, or even partners (such as a real estate investor) who are eager to be part of your real estate investing for house flipping in exchange for a cut of the earnings.

When looking for financial partners, follow these:

- Browse through online forums of real estate investors and see if someone is willing to partner with you.

- Look for the best loan deal offers.

- Prepare your business strategies and detailed plan once you’ve found a potential financial partner.

Legal and Tax Professionals

The legal work, personal finance, taxation (such as property taxes), etc., are complicated, and they should be left to professionals.

Of course, you’d like someone or a team of them that aren’t just licensed but skillful enough to navigate through the legality of house flipping.

When looking for legal and tax professionals, follow these:

- Ask for recommendations from other experts from the house-flipping industry.

- Seek attorneys and accountants who are experts in real estate investing and taxation.

- Plan consultations to discuss your needs to ensure a perfect match.

Other Teams

Depending on the size and scope of your house-flipping business, you may also need to consider adding more team members.

There might be a need to consider the following:

- Architects or designers

- Property inspectors

- Marketing and staging professionals

- Real estate attorneys

- Homeowners insurance agent

Analyzing, Making Offers, and Selling the Property

When you’re done with all the needed renovation, the most difficult part of flipping houses comes in: selling.

This process can make or break your flipping success, as it determines your potential profit and the project’s overall feasibility.

In short, it all comes down to your ability to negotiate.

Just don’t forget that you should aim for at least 20-30% clean profit from the average gross profit.

Computing for the AVR

Computing for the After Repair Value (ARV) of your flip house helps evaluate its potential profit.

This is the projected worth of the home once all maintenance and improvements are finished.

To estimate the possible selling price for your flip property, look for nearby comparable houses that have recently sold.

Computing for MAO

Once you get your ARV, you may now determine the Maximum Allowable Offer (MAO) for your flip house using it.

In computing the MAO, the closing and renovation costs are also included.

It’s the highest amount you should be prepared to offer for the house to guarantee a 20% – 30% profit.

One common formula any real estate investor has used at least once in their lifetime is the 70% method, which is as follows:

MAO = (ARV x 0.70) – RE – CC

- MAO. Maximum Allowable Offer

- ARV. After Repair Value

- RE. Repair Estimation

- CC. Closing Costs

This formula accounts for a 30% profit margin, which should include almost everything, including potential financial risk, that’s associated with the project.

Now, let’s try computing the MAO of a hypothetical situation for illustration purposes.

Suppose you have found a potential flip house in a marketable neighborhood.

After researching the local market, you discovered that similar renovated properties in the area sell for around $300,000.

This will be your estimated After Repair Value (ARV).

Upon careful inspection of the property and consultation with your contractor, you estimate that the necessary repairs and renovations will cost approximately $50,000.

This will be your Repair Estimation.

Afterward, your legal team told you the closing cost could be $8,000.

Now, to calculate the MAO to determine the highest price you can offer while ensuring a profitable flip, do the following:

Using the formula above:

- MAO = (ARV x 0.70) – RE – CC

Substitute the values for the ARV, Renovation Estimation, and closing costs:

- MAO = ($300,000 x 0.70) – $50,000 – $8,000

Calculate the result:

- MAO = $210,000 – $50,000 – $8,000

- MAO = $152,000

The highest you can offer to your potential buyer is $152,000.

Selling the Property

When you know what your MAO is, it’s now time to bargain with the buyer.

Sell the property as soon as possible since you’re gaining and paying interest for your loan the longer it takes.

Still, don’t make it obvious that you’re desperate to sell it; ensure that you sound authoritative while being polite when presenting your offer, and be prepared to justify the suggested price.

Remember that negotiation is a two-way channel, so be open to counteroffers and find a middle ground in the purchase price that works for both of you.

Learning From Your “Flips”

The ability to learn from your errors is one of the most important components of being successful in flipping houses.

The question is, how can you make use of this knowledge to better scare your business?

Well, take a look at the following “flips” of flipping houses:

Lack of Market Research

Many launches into the “concept” immediately when they start flipping houses without completing in-depth market research.

For example, you got a cheap distressed property, but the marketability of it in the area is almost close to impossible.

This might result in a lack of comprehension of the target market’s demands and, in turn, will lead to failure.

Therefore, you’ll have difficulty selling it; worse, you might not sell it at all.

So, Before buying a house, thoroughly investigate the market.

Recognize your area’s buyer preferences, property prices, and market trends. This will assist you in choosing which houses to flip and how best to remodel them so that they appeal to prospective buyers.

Not Thinking Too Much About the Costs

Another mistake made when flipping houses is underestimating the expenses involved in buying, remodeling, and selling them.

It can result in budget overruns, cash flow problems, and decreased earnings.

So, you must make a thorough budget for every project, taking into account the purchase price, renovation costs, holding costs, and selling expenses, among others.

Be reasonable and set up money for unforeseen expenses.

To ensure you stay on track, evaluate and revise your budget often during the whole project duration.

Substandard Property Inspection

Some home flippers neglect to do comprehensive property inspections to save time and money.

This could result in expensive remodeling, which can deal with structural problems or unseen damage.

Basically, there’s a chance that you’ll lose money instead of earning.

That’s why before you buy and flip a house, always perform a comprehensive inspection.

It’ll help you identify potential issues with your contractor and factor them into your budget and renovation plan.

Poor Project Management

Project management mistakes can cause delays, cost overruns, and poor-quality work.

House flippers who try to handle everything themselves or improperly supervise contractors may find it difficult to finish tasks on schedule and on a reasonable budget.

With that said, try to develop good project management skills, and don’t just do everything on your own—assign duties. That’s why you have a team.

In order to keep the project on schedule, communicate with contractors clearly about timeframes, costs, and expectations.

Over-Improving Properties

Sometimes, we forget to think that what we’re doing is selling the flip house for a reasonable profit, not owning it, and end up over-improving things. This can lead to budget overrun.

That leaves you nothing but to have a higher price for it in order to recoup your investment.

When it comes time to sell, it’ll be difficult since buyers might be too hesitant to deal with you in the first place if what you’re selling is too high for the local market value.

To avoid this, concentrate on making improvements that increase value and appeal to the vast majority of local buyers.

Go back to your market research and see how others model their flip house.

Of course, your team is there to help you, especially your contractor.

Scaling Your House Flipping Business Effectively

After going through some of the major challenges that home flippers face, let’s now talk about how to scale your business successfully.

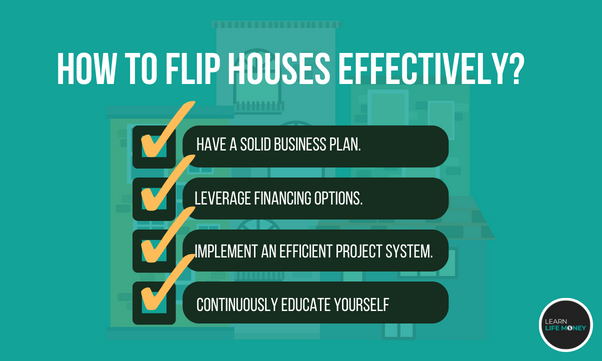

- Have a solid business plan. Describe your objectives, target market, financial forecasts, and growth plans. Also, review and update your business strategy regularly to ensure you stay on course and can adjust to shifting market conditions.

- Leverage financing options. As your business grows, You’ll probably need more money to support your projects. In that case, always have lots of backup plans for financing.

- Implement an efficient project system. You may streamline your budgeting, communication, and project management procedures to increase effectiveness and lower the possibility of mistakes.

- Continuously educate yourself. Keeping up with market changes is essential for growing your business in the real estate industry. Stay current on market trends, best practices, and new opportunities.

Final Thoughts

You see, there’s a lot to learn when it comes to flipping homes, especially if you’re still a beginner at flipping a house.

Wherever you are in your house flipping project right now, this comprehensive guide will help you close a profitable flip house deal.

#Comprehensive #Guide #Beginners