How to Set Up a Living Trust?

Are you looking for an estate planning tool that provides control, privacy and avoids the time-consuming probate process?

A living trust may be the solution you’re searching for!

In this blog, I will guide you through a step-by-step process on how to set up a living trust in 2023, ensuring your assets are managed according to your wishes and seamlessly transferred to your beneficiaries upon your death.

By understanding the different types of living trusts, evaluating your estate, and following this detailed guide on how to set up a living trust, you’ll be well-equipped to make informed decisions about your estate planning.

I have just completed this myself, so while it is fresh in my mind, I wanted to create this to help others.

So let’s dive in and explore the world of living trusts!

Short Summary

- Living trusts are a useful legal instrument for estate planning and involve four key roles: grantor, trustee, successor trustee, and beneficiary.

- When you set up a living trust, consider which assets to include and understand the common mistakes to avoid.

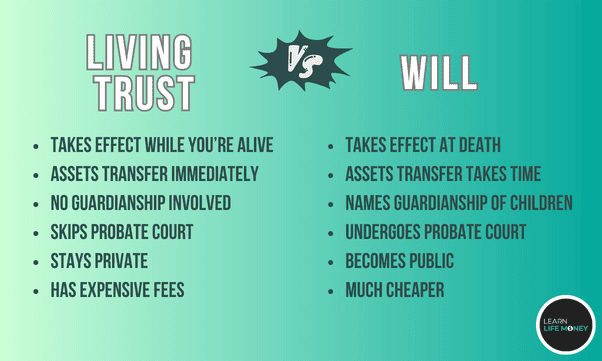

- A living trust differs from a will in terms of privacy, probate avoidance, and flexibility.

- Understanding these differences can help make informed decisions about asset management.

Understanding Living Trusts

A living trust is a legal arrangement that offers numerous advantages, such as:

- Transfer assets

- Maintain control during your lifetime.

- Designate beneficiaries after your death.

- Flexibility

- Privacy

- Ability to bypass the public probate process, which can be both time-consuming and costly.

To fully grasp the concept of living trusts, it’s essential to understand the different types available and the roles involved in the trust.

Understanding this will empower you to make decisions about estate planning and manage your assets effectively.

Types of Living Trusts

There are 2 primary types of living trusts: revocable and irrevocable trusts.

The revocable living trust is flexible and can be modified or revoked at the grantor’s discretion.

This type of trust allows you to maintain control of the trust property during your lifetime, and you can alter or modify it at any point.

Revocable living trusts, being one of the most common types, offer great flexibility for those looking to secure their assets.

On the other hand, you can convert a revocable trust into an irrevocable living trust.

This conversion restricts actions after its establishment, offering less flexibility.

However, it protects assets in an irrevocable trust, including bank accounts, from the grantor’s creditors.

When deciding between a revocable and irrevocable living trust, it’s important to consider the level of control you desire and the specific tax implications of each type.

While revocable trusts are more common and flexible, irrevocable trusts offer additional asset protection and tax benefits.

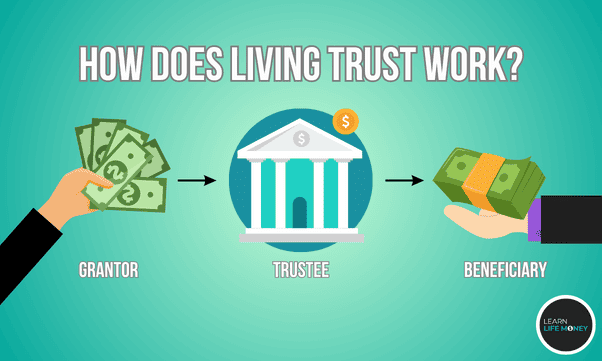

Roles in a Living Trust

In a living trust, there are four primary roles:

- The grantor: the individual who establishes and places assets into the trust. It’s common for grantors to appoint themselves as the trustee to maintain control of their assets during their lifetime.

- The trustee: responsible for managing the trust’s assets.

- The successor trustee: named to take over the role of trustee after the grantor’s death or incapacity.

- The beneficiary: the person or entity who will receive the assets of the trust.

The successor trustee steps in to administer the trust in the event of the grantor’s incapacity or death.

Beneficiaries, on the other hand, are individuals or organizations legally entitled to the assets held within the trust.

Understanding these roles is crucial for setting up a living trust that aligns with your estate planning goals.

This also ensures a smooth transition of assets to your chosen beneficiaries.

Evaluating Your Estate

Before diving into the process of setting up a living trust, it’s important to evaluate your estate.

This involves assessing the value of your property holdings, considering potential estate tax implications, and determining which assets to include in the trust.

By examining your estate, you’ll have a clear understanding of your assets, enabling you to make informed decisions when setting up your living trust.

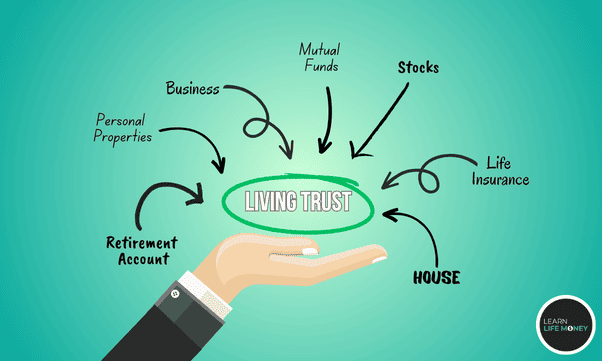

Assets to Include

When deciding which assets to include in your living trust, it’s essential to focus on high-value assets, such as real estate, investments, and valuable personal property.

Low-value or insured assets, like vehicles, may be omitted.

If you’re uncertain about a particular asset’s value, scheduling an appraisal to accurately determine its worth is recommended.

Including the right assets in your trust ensures a smooth property transfer to your beneficiaries and helps avoid probate.

Estate Tax Considerations

When setting up a living trust, it’s crucial to consider the possible impact of estate taxes on your assets and beneficiaries.

Estate taxes are imposed upon the transfer of assets from a deceased individual to their beneficiaries.

To ensure your estate plan aligns with your financial affairs, consult with an estate attorney.

You can discuss tax implications and strategies for minimizing the tax burden on your estate.

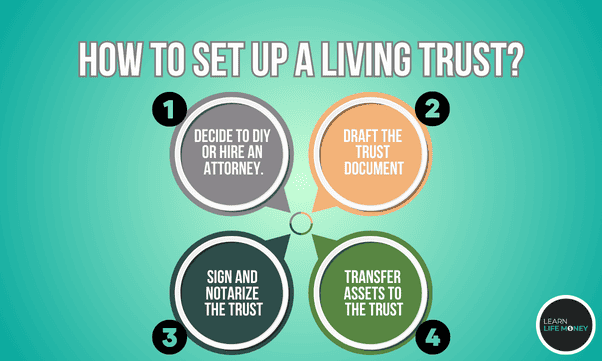

Step-by-Step Guide to Setting Up a Living Trust

Now that you have a solid understanding of living trusts and have assessed your estate, it’s time to set up your own living trust.

In this step-by-step guide, we’ll walk you through the process of establishing a living trust.

- Decide whether to do it yourself or hire an attorney.

- Draft the trust document.

- Sign and notarize the trust.

- Transfer assets to the trust.

Following this guide will ensure a seamless setup of your living trust.

It can provide the peace of mind that your assets will be handled based on your wishes and transferred to your beneficiaries without probate court involvement.

DIY or Hire an Attorney

When it comes to setting up a living trust, you have two options: doing it yourself or hiring an estate planning attorney.

If your estate is relatively simple and you’re comfortable with legal documents, you may opt to create a living trust on your own.

However, if your estate is more complex or you’re unsure about the legal aspects of setting up a trust, it’s advisable to consult with an estate planning attorney.

An attorney can provide valuable insight and guidance throughout the process, ensuring your trust is properly drafted and compliant with state laws.

The decision between DIY and hiring an attorney depends on the complexity of your estate and your comfort level with legal documents.

Drafting the Trust Document

Whether you’ve decided to create the trust yourself or work with an attorney, the next step is drafting the trust document.

This legal document summarizes the terms and conditions of your living trust and specifies the roles of the grantor, trustee, successor trustee, and beneficiaries.

It’s crucial to include detailed descriptions of the property and instructions on who will receive which assets upon your death.

Take your time when drafting the trust document, ensuring that it accurately reflects your wishes and complies with your state’s laws.

If you’re unsure about any aspect of the trust document, it’s always best to consult with an estate planning attorney for guidance.

Signing and Notarizing the Trust

After drafting the trust document, it’s essential to sign and notarize it to ensure its legality and enforceability.

This step involves signing the trust document in the presence of a notary public, who will verify your identity and witness your signature.

This step solidifies the trust document, providing a strong legal foundation for your living trust.

Transferring Assets to the Trust

When your trust document is signed and notarized, the final step is transferring assets to the trust.

This involves changing the title or ownership of the assets to the trust’s name.

It’s important to ensure that all assets are accurately registered in the name of the trust.

And, of course, to maintain meticulous records of all assets transferred to the trust.

Properly transferring assets to the trust is crucial in avoiding probate and ensuring the smooth distribution of assets to your beneficiaries.

Maintaining and Updating Your Living Trust

Establishing a living trust is just the beginning of your estate planning journey.

To ensure your living trust remains accurate and relevant to your current situation, reviewing and updating the trust regularly is essential.

This involves assessing the trust document, identifying any necessary changes, and amending the trust as needed.

By maintaining and updating your living trust, you can ensure its effectiveness in managing your assets and providing for your beneficiaries, both during your lifetime and after your death.

Regular Reviews

Scheduling periodic reviews of your living trust is vital to identify any necessary updates or changes. Life events such as:

- marriage

- divorce

- the childbirth

- the acquisition of new assets

Life events, such as the birth of minor children, may necessitate updates to your trust document.

Regularly examining your living trust allows you to make essential modifications.

It also ensures that your trust remains accurate and effective in managing your assets and providing for your beneficiaries.

Amending the Trust

When life changes occur or new assets are acquired, it’s important to amend your living trust to reflect your current circumstances.

The process of amending a living trust may vary according to the state and the particular trust document but can involve creating a new trust document.

This adds an addendum to the original trust document or using a trust amendment form to modify specific provisions.

Regularly amending your trust ensures that it remains effective in managing your assets and providing for your beneficiaries.

Common Mistakes to Avoid

In setting up and maintaining a living trust, there are several common mistakes to avoid.

These mistakes can result in unnecessary complications, delays in the distribution of assets, and unintended consequences for your beneficiaries.

By being aware of these pitfalls and taking suitable precautions, you can ensure that your living trust remains accurate, effective, and aligned with your estate planning goals.

In this section, we’ll discuss two common mistakes to avoid when setting up and maintaining your living trust.

These are incomplete asset transfers and neglecting to update the trust.

Incomplete Asset Transfers

One of the most critical aspects of setting up a living trust is ensuring that all assets are properly transferred to the trust.

Incomplete asset transfers can result in assets being subject to probate.

This causes delays in the distribution of assets, additional costs, and unintended beneficiaries receiving assets.

To avoid these complications, confirm that all assets are accurately registered in the name of the trust and diligently maintain records of all assets transferred to the trust.

Neglecting to Update the Trust

Regularly updating it to ensure accuracy and effectiveness is just as important as setting up your living trust.

Failing to update your trust can result in legal issues and unintended consequences.

So, it’s vital to review the trust document and make any necessary adjustments periodically.

By staying proactive in updating your living trust, you can guarantee that it remains aligned with your current circumstances and estate planning objectives.

Living Trust vs. Will

As you consider your estate planning options, it’s essential to understand the differences between a living trust and a will.

While both serve the purpose of distributing assets upon your death, there are key distinctions in terms of privacy, probate avoidance, and flexibility that can impact your choice of estate planning tools.

In this section, we’ll examine the differences between living trusts and wills.

Hopefully, this will help you determine which option is best suited to your estate planning needs and financial goals.

Final Thoughts on How to Set Up a Living Trust

In conclusion, setting up a living trust is an effective estate planning tool that allows you to control your assets during your lifetime and seamlessly transfer them to your beneficiaries upon your death.

By understanding the different types of living trusts, evaluating your estate, and following our comprehensive step-by-step guide, you’ll be well-equipped to make informed decisions about your estate planning.

Remember, it’s essential to regularly review and update your living trust to ensure its accuracy and effectiveness in managing your assets and providing for your beneficiaries.

With a well-crafted living trust, you can enjoy peace of mind knowing that your estate will be taken care of based on your wishes and without probate court involvement.

Frequently Asked Questions

What is the downside to a living trust?

The downside to setting up a living trust is the financial cost and effort it takes to establish the trust and transfer assets into it.

Additionally, if you choose to act as the trustee of your own trust, you must keep careful records that reflect your decisions.

Finally, there are greater disclosure requirements for a trust than for a will.

What assets should not be in a trust?

Generally speaking, assets that cannot be placed in a trust are not transferable or have no value outside of the owner’s use, such as social security benefits, certain public benefits, and business interests.

It is best to consult an attorney about which assets may not be appropriate for a trust.

What are the pros and cons of a living trust?

Living trusts offer the benefit of efficient asset management and the protection of assets from probate courts.

However, this option requires professional advice and costly legal fees in order to set up.

Additionally, a living trust offers no protection from creditors and taxes.

All in all, living trusts can be a great way to manage assets with more privacy, but they may not be the most cost-effective option depending on individual needs.

What is the difference between a living trust and a regular trust?

Living Trusts are set up during a person’s lifetime, while regular trusts are established in a Will when a person passes away.

In addition, Living Trusts can be modified or revoked at any time, while regular trusts remain fixed.

What is the main purpose of a living trust?

The primary goal of a living trust is to allow individuals to plan ahead for what will happen to their possessions and assets after death without going through the costly and time-consuming process of probate.

It is a legal process that involves the court system and can be expensive and lengthy.

By creating a living trust, individuals can ensure that their assets and possessions are distributed according to what they want without going through the probate process.

#StepbyStep #Guide