Why Are Houses So Expensive?

Buying a house isn’t as easy as buying a ticket to your five-days-six-nights vacation; it’s an investment that will surely need more money than that.

You see, in San Francisco, houses are 113% more expensive in 2022 alone, especially in the San Francisco-Oakland-Berkeley metro area, due to rising interest rates and land costs in the real estate market.

Imagine the median household income of Americans is $70,785, and average houses cost about $501,000. That’s a $430,215 difference! The math isn’t matching, now, isn’t it?

The point is houses are expensive (title drop). Yeah, they’re expensive-expensive; ask anyone from the housing market.

If you’re new to the real estate market, you’ll be astounded by how expensive houses can be, especially if they’re built in urban areas.

The closer you are to the bustling city, the higher the prices are.

However, that’s not the sole factor that determines a house’s overall price.

In this blog, I’ll share with you my knowledge about the important economic factors that determine how a house is priced and why home prices are expensive.

Supply and Demand

You surely know how supply and demand work, right?

That’s just the same with houses as well.

The higher the demand for houses is, the higher the prices.

So, if you’re wondering: “Why are houses so expensive?” Supply and demand in the housing market is the root cause.

Technically, fundamental economics’ supply and demand laws apply to the housing market just like they do to any other market.

Prices usually rise when there’s a significant demand for homes. In contrast, prices tend to go down when there’s a low demand for them.

This straightforward idea is at the heart of the high cost of housing (and its concept will be evident throughout this blog).

Population Growth and Its Impact on Housing Demand

The population of a particular place heavily impacts the prices of houses in that region.

Why?

It’s because more people need a place to live as the population grows, which raises the demand for homes.

People frequently relocate to locations with robust job markets and acceptable living conditions for greater possibilities.

Population expansion has outpaced the building of new housing units in many nations, creating a shortage of available homes and raising their costs.

This is especially true in heavily populated metropolitan regions where building costs are high, and land is scarce.

Urbanization and the Concentration of Job Opportunities in Cities

The demand for housing in urban locations rises as more individuals relocate to cities for better employment prospects and a higher standard of living.

This particularly affects the bustling cities with thousands of job opportunities, such as those in the technology, finance, and healthcare industries.

Due to the concentration of employment prospects in urban areas, people are ready to pay more for housing near their places of employment.

That said, it raises the supply and demand problem of houses and their prices.

Land Availability

In the housing market, home prices are also greatly affected by the available land they’re built on.

Limited Land for Development in Urban Areas

You must know that one of the primary causes, and the most obvious, of the high cost of housing is the scarcity of development land, particularly in metropolitan regions.

So to speak, as cities expand and the population grows, so does the need for homes.

Unfortunately, the quantity of land available for construction does not always meet this demand, resulting in a lack of housing alternatives and higher prices.

In fact, according to the World Bank, metropolitan areas already house more than half of the world’s population, and this figure is likely to rise in the future, worsening the problem of restricted land supply.

Zoning Regulations and Their Impact on Housing Supply

Various zoning rules are another recurring issue in the housing market that might limit the availability of land for home construction.

These restrictions govern how land may be utilized in certain locations, frequently limiting the development of new housing units in specified communities.

The Urban Institute found that stringent zoning restrictions can contribute to high house costs by reducing the supply of new residences. This, in turn, can create competition among potential buyers, driving up prices even further.

In an analysis of Edward L. Glaeser, he also mentioned that overly restrictive zoning regulations have somehow limited the supply of homes, skyrocketing home prices.

Thus, it’s evident that zoning regulations have bearings in the overall housing market and the rising housing prices.

Land Use Policies and Their Effect on Housing Prices

Land use policies, such as urban expansion boundaries and conservation easements, can significantly influence house values.

By limiting development in some places, these regulations aim to safeguard rich natural resources, agricultural land, and open spaces.

However, while these regulations help the environment and society, they can also contribute to the high cost of housing by lowering the quantity of land available for construction.

Construction Costs

Another factor in the housing market that raises home prices is its construction costs.

Rising Housing Costs of Construction Materials

Due to the pandemic, it’s inevitable for home prices to go up, including the materials used in constructing a house.

The cost of construction, which includes not all building materials, has risen significantly in recent years.

This caused a lot of commotion in the construction sector.

Various factors contribute to the increase, including global supply chain problems, rising housing demand, and trade tensions (especially with what’s happening between Russia and Ukraine right now).

Furthermore, prices for key commodities such as timber, steel, and concrete have all risen, raising the entire cost of construction projects.

Lumber, for example, has surged in price due to increasing demand for new building and remodeling projects, along with limited output during the COVID-19 epidemic.

On the other hand, steel prices have risen due to trade restrictions and tariffs, while concrete costs have grown due to increasing demand for infrastructure projects.

Labor Costs and the Skilled Labor Shortage

It isn’t easy to find contractors with great skills these days, and the lack of trained staff in the construction sector is a crucial factor driving up home prices.

Again, it’s supply and demand all over again.

You see, many unqualified employees have entered the housing market to replace the many construction workers who departed during the 2008 crisis.

Technically, it’s getting expensive to hire a construction worker as a result of the labor shortage when businesses battle to hire and retain qualified workers, heavily affecting house prices.

Furthermore, the aging workforce and a lack of interest in construction employment among younger generations made this problem even worse.

As a result, building projects are taking longer to finish, and labor expenses are rising, which raises home prices as a whole.

Impact of Building Codes and Regulations on Construction Costs

Building rules and regulations are essential for ensuring building projects are safe, high-quality, and long-lasting. However, they can also push up home prices.

Construction businesses must adapt and make new investments in equipment, training, and procedures to comply with these laws as building standards become more demanding and include new technologies and materials.

For instance, adopting energy-efficient construction rules has boosted the usage of high-performance HVAC systems, windows, and insulation, which can be more expensive than conventional ones.

Additionally, it might take time and money for developers to navigate intricate zoning restrictions and secure permissions.

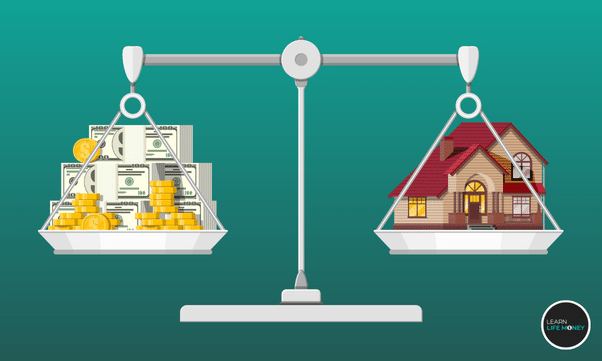

Financing and Mortgage Rates

Let’s now enter the business side that made home prices expensive.

Role of Mortgage Rates in Housing Affordability

Mortgage rates significantly influence the affordability of homes.

You see, homebuyers borrow money from financial organizations through mortgages to pay for their homes. The interest rate imposed on this loan is known as the mortgage rate.

So, low rates result in lower borrowing costs, which lowers the cost of borrowing and increases the affordability of homeownership for prospective purchasers.

On the other hand, high borrowing costs make it more expensive for prospective homebuyers to fund a home purchase when rates are high.

Therefore, increased rates might result in less demand for homes, greatly affecting housing prices.

Government Policies and Their Influence on Mortgage Rates

Government policies can also affect mortgage rates and, as a result, the affordability of home prices. In fact, there’s currently a housing affordability crisis.

Central banks, such as the Federal Reserve in the United States, set the benchmark interest rates that determine the cost of borrowing in the economy.

The thing is, central banks can indirectly affect mortgage rates by changing these interest rates.

For instance, commercial banks and other financial organizations can obtain funds at a lesser cost when a central bank reduces the benchmark interest rate.

By providing reduced mortgage rates, these financial institutions may, in turn, allow customers to benefit from cheaper borrowing expenses.

So to speak, reduced mortgage rates enhance home demand and raise house prices.

I’ll speak more about how government policies affect home sales and prices in the last blog section.

The Relationship Between Interest Rates and Housing Prices

Housing costs and interest rates are closely related to “why are houses so expensive.”

As was already noted, when interest rates are low, mortgage rates also tend to be low, which makes it more possible for buyers of homes to borrow money to finance a home purchase.

Because housing is now more accessible, there may be greater demand for homes, raising housing costs (the whole point of this blog).

It’s more expensive for homebuyers to borrow money to buy a property when interest rates are high than when they’re low.

Real Estate Investment

Investments, investments, investments. While they’re good, they also have their negative consequences, just like any other things, that make houses expensive (if you know the yin and yang principle, you know what I’m talking about).

Real Estate as an Investment Vehicle

Real estate has long been regarded as a reliable and successful investment option. The possibility of passive income, capital growth, and tax advantages draws investors.

However, real estate investments can also act as a boundary against inflation because rising property values and rental revenue are common occurrences.

As a result, there’s now more demand for homes, raising prices and making it more challenging for first-time buyers to enter the market because of the rising home prices.

Impact of Foreign Investment on Housing Prices

The increase in housing costs has also been attributed to foreign real estate investment.

Wealthy people and institutional investors worldwide viewed Real Estate as a safe refuge for cash.

This flood of foreign money has increased housing competition, raised prices, and made it more challenging for locals to buy homes.

Speculation and Its Role in Driving Up Housing Prices

Another factor in “why are houses so expensive” is speculation.

Investors often purchase real estate, hoping it will increase in value over time.

This kind of speculative activity can lead to artificially inflated property values in housing bubbles.

Housing values may crash when these bubbles pop, leaving homeowners with negative equity and sparking a wave of widespread foreclosures.

Government Policies and Regulations

Okay, so this is the section I talked about where I’ll focus more on how government policies and regulations heavily affect home prices.

Tax Policies and Their Impact on Housing Affordability

So, right off the bat, we’ll talk about how tax policies impact housing affordability.

You see, tax benefits for homeowners, like the deduction for mortgage interest, can promote home ownership by increasing its financial appeal.

However, these tax benefits may also help drive home costs by boosting demand.

On the other hand, property taxes can limit speculation and support neighborhood public services, but they can also raise the cost of housing for low-income people.

Affordable Housing Programs and Their Effectiveness

Government programs can also enhance the availability of low-cost housing for low-income families.

Public housing initiatives, housing vouchers for low-income households, and subsidies for developers building economical housing units are a few examples of these schemes.

While these initiatives can help make housing more affordable, they frequently run into obstacles, including a lack of money, bureaucratic red tape, and opposition from locals who may be worried about how it would affect their property prices and community character.

Rent Control Policies and Their Impact on Housing Prices

Rent control laws are created to shield tenants from disproportionate rent increases and guarantee low-income families have access to low-cost housing.

These regulations can aid in stabilizing the rental market and avoiding the eviction of long-term residents.

However, rent regulation may also have unexpected effects that hinder new development, cut down on the availability of rental homes overall, and reduce property upkeep.

In the long term, this may lead to a lack of affordable housing alternatives and raise housing prices.

Final Thoughts on Why Are Houses So Expensive

“Why are houses so expensive,” you say? Well, it’s because of these factors.

However, they’re only some of the most prevalent in raising home prices. Of course, there are still other factors, but they usually fall into one of the factors mentioned in this blog.

So, if you’re still renting but are saving money to buy a house, expect that house prices may go up yearly.

#Houses #Expensive #Factors #Affect #House #Prices